Notes to the Financial Statements

31 December 2015

26.

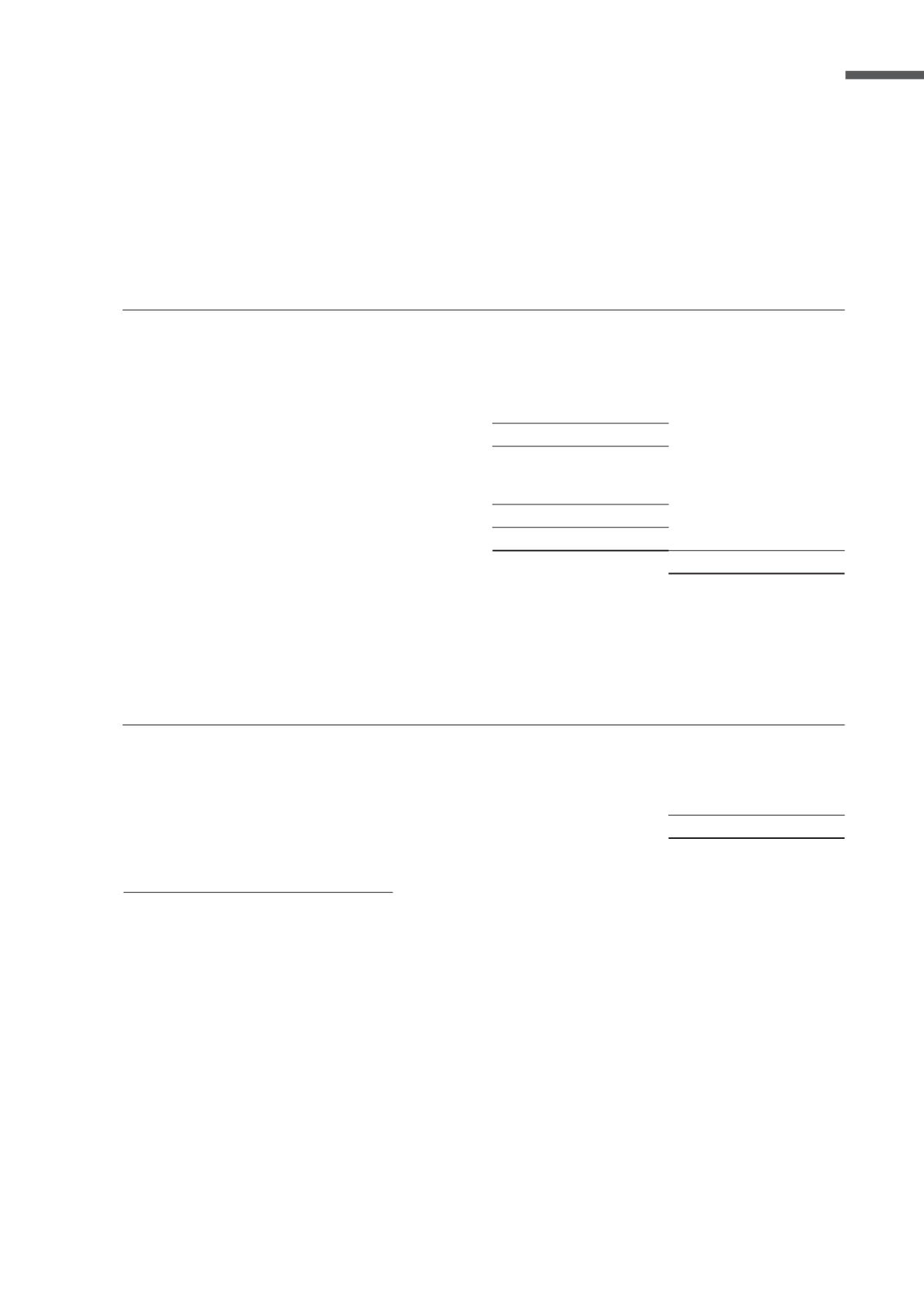

Deferred taxation

Deferred tax as at 31 December relates to the following:

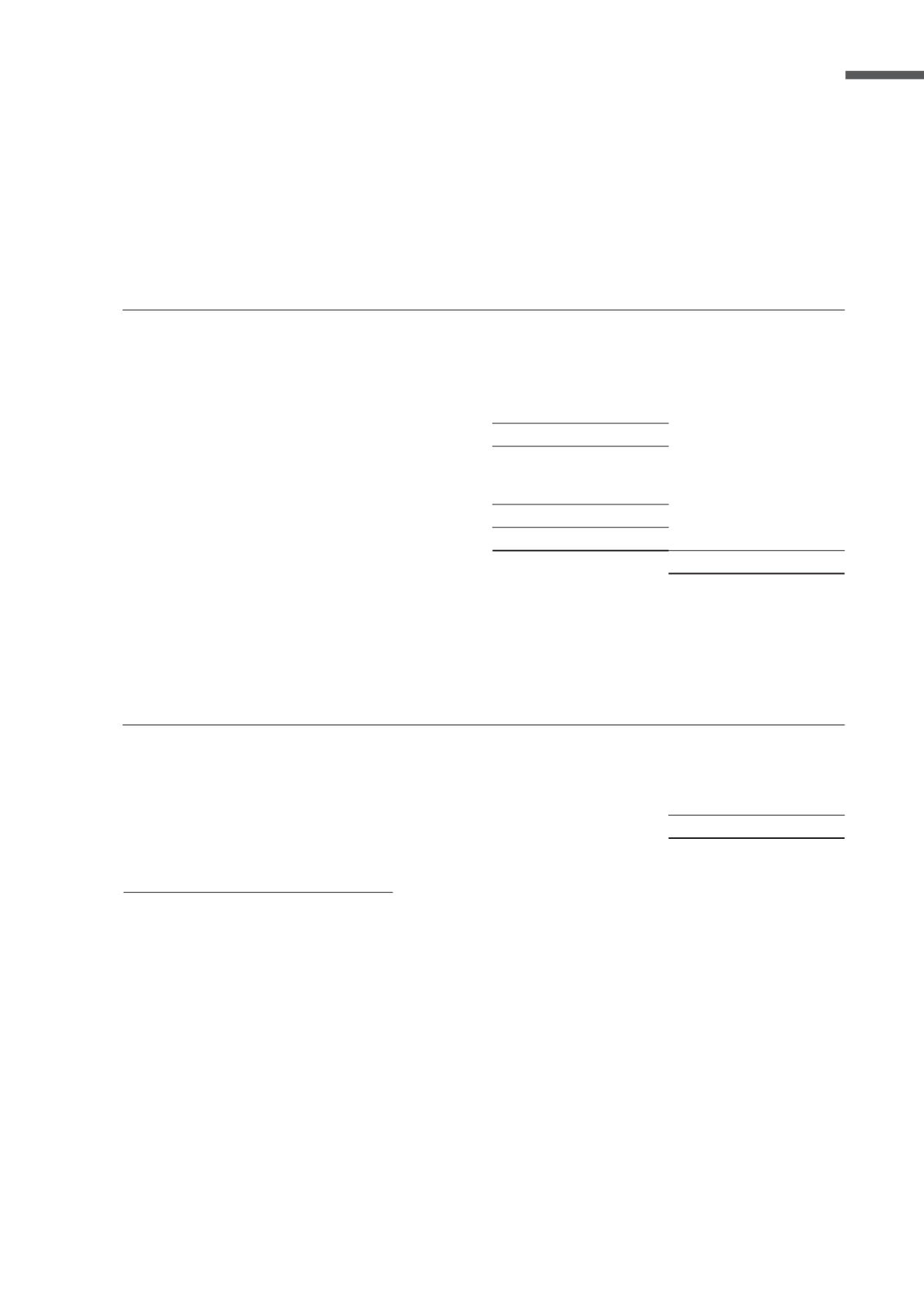

'HIHUUHG WD[ DVVHWV DQG OLDELOLWLHV DUH RVHW ZKHQ WKHUH LV D OHJDOO\ HQIRUFHDEOH ULJKW WR VHW R FXUUHQW WD[ DVVHWV

against current tax liabilities and when the deferred taxes relate to the same taxable entity and the same taxation

DXWKRULW\ 7KH DPRXQWV GHWHUPLQHG DIWHU DSSURSULDWH RVHWWLQJ DUH LQFOXGHG LQ WKH FRQVROLGDWHG EDODQFH VKHHW

as follows:

Tax consequences of proposed dividends

There are no income tax consequences (2014: S$Nil) attached to the dividends to the shareholders proposed by

WKH &RPSDQ\ EXW QRW UHFRJQLVHG DV D OLDELOLW\ LQ WKH ȴQDQFLDO VWDWHPHQWV 1RWH

Group

2015

2014

S$’000

S$’000

Net deferred tax assets

6,897

6,978

Net deferred tax liabilities

ȫ

(3)

6,897

6,975

Group

Consolidated

balance sheet

Consolidated

income statement

2015

2014

2015

2014

S$’000

S$’000

S$’000

S$’000

Deferred tax assets

Provisions

7,712

7,544

(168)

(6,569)

Unutilised tax losses

235

415

180

(269)

7,947

7,959

Deferred tax liabilities

Excess of net carrying value of property, plant and

equipment over tax written down value

(1,050)

(984)

66

139

(1,050)

(984)

6,897

6,975

Deferred tax expense/(credit)

78

(6,699)

ANNUAL REPORT 2015

77