Notes to the Financial Statements

31 December 2015

21.

Trade and other payables

Trade payables

Trade payables are non-interest bearing and are normally settled on 30-60 days’ terms.

Amount due to a subsidiary

In 2014, amount due to a subsidiary was non-trade related, unsecured, non-interest bearing and repayable on

demand. The amount has been fully repaid in the current year.

Other payables

Other payables are non-interest bearing and have an average term of 2 months.

In 2014, the deferred income arose from the elimination of intra-group loan interest income charged on a loan

to a joint venture, Bukit Timah Green Development Pte Ltd, which was in excess of the carrying amount of the

Group’s interest in the joint venture. In the current year, the deferred income was reversed as the carrying

amount of the Group’s interest in the joint venture exceeded the elimination of intra-group loan interest income.

22.

Amounts due from/(to) a joint venture partner

Amounts due from/(to) a joint venture partner are trade related, unsecured, non-interest bearing, repayable upon

demand and are to be settled in cash.

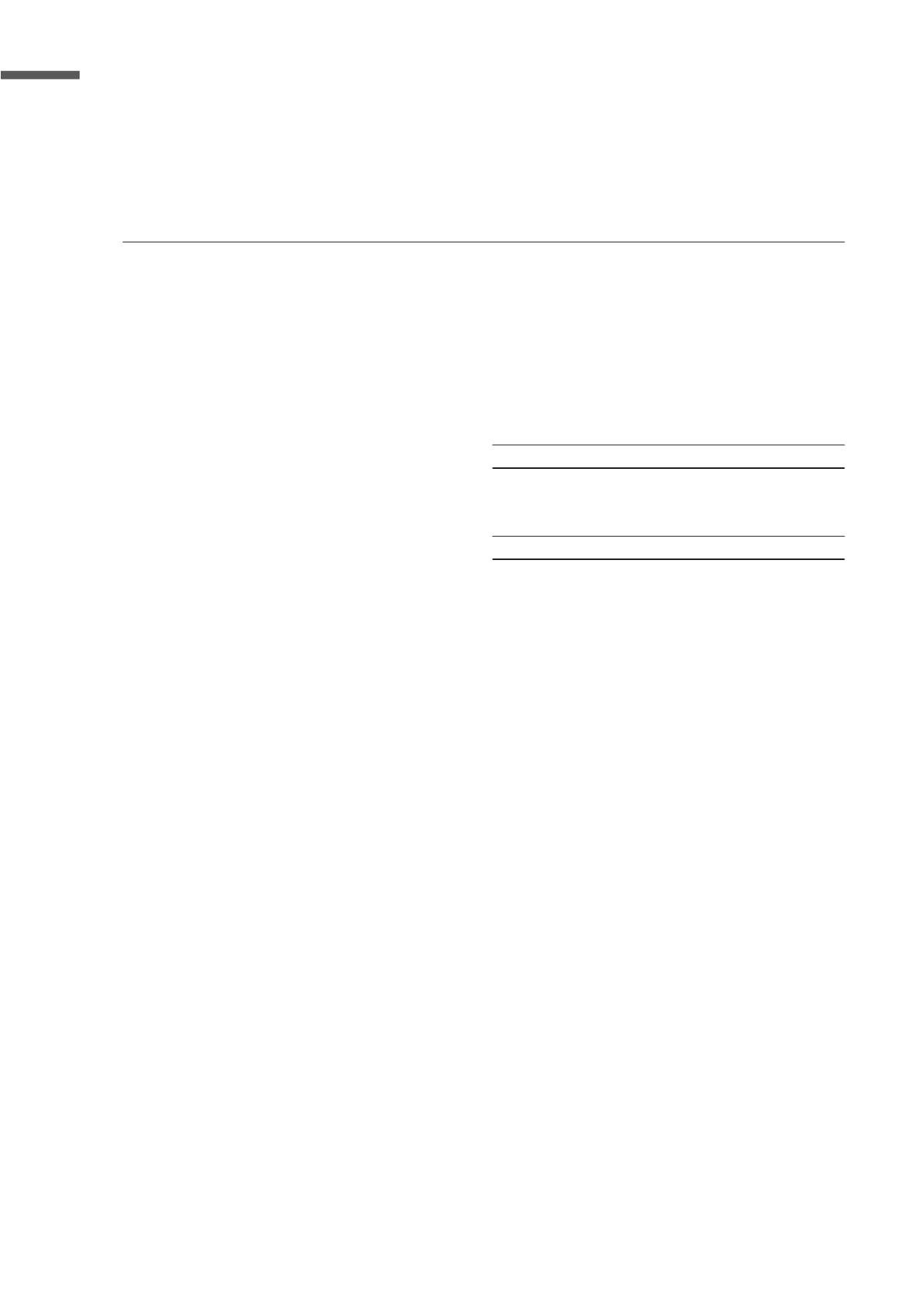

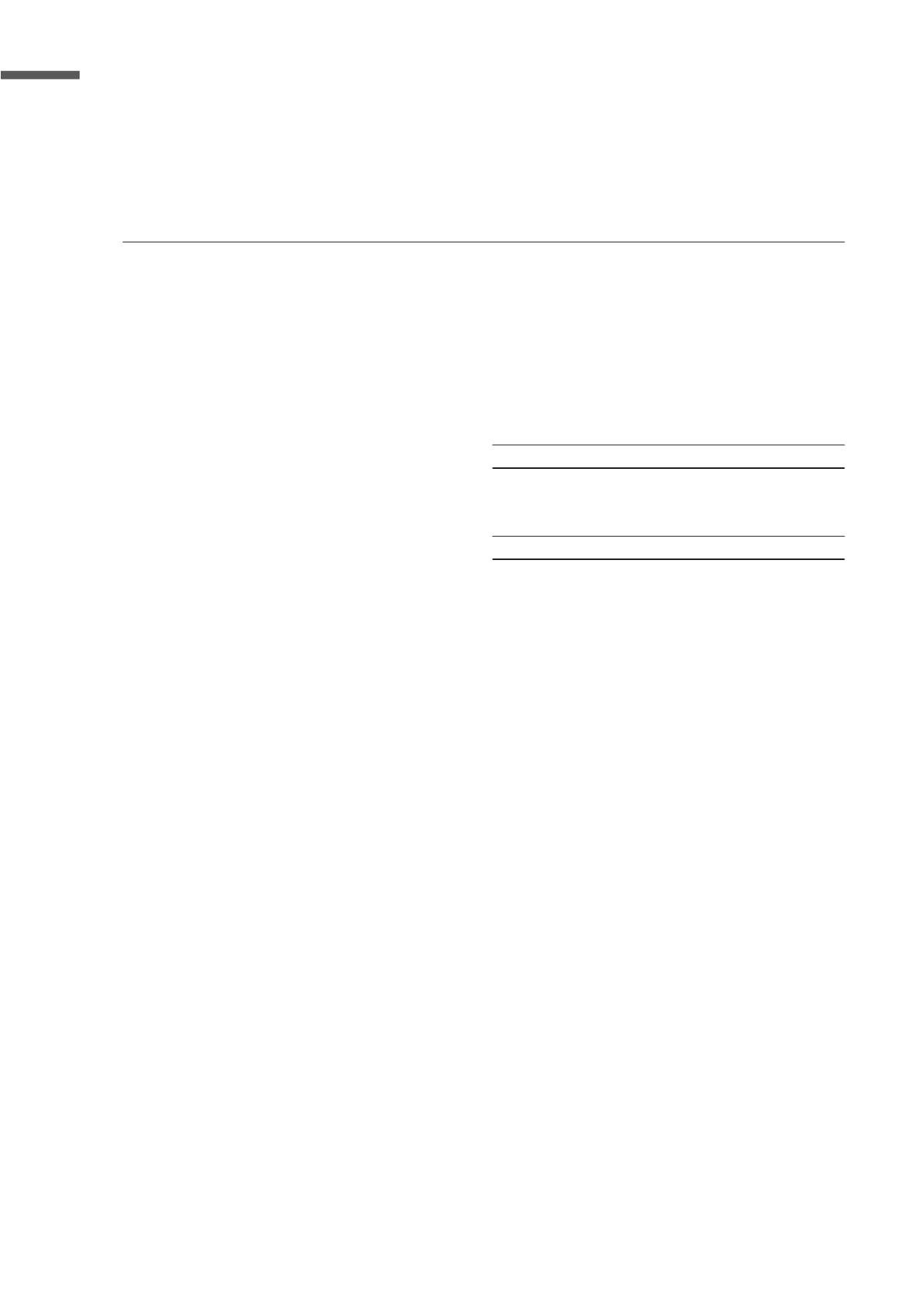

Group

Company

2015

2014

2015

2014

S$’000

S$’000

S$’000

S$’000

Current

Trade payables

3,465

3,133

9

7

Accrued operating expenses

46,917

49,832

1,429

3,295

Amount due to a subsidiary

–

–

ȫ

1,000

Deposits received

47

1,123

–

–

GST payables

359

6,784

52

17

Other payables

39

446

1

–

50,827

61,318

1,491

4,319

Non-current

Deferred income

ȫ

1,227

–

–

ȫ

1,227

–

–

HOCK LIAN SENG HOLDINGS LIMITED

74