Notes to the Financial Statements

31 December 2015

17.

Trade receivables (cont’d)

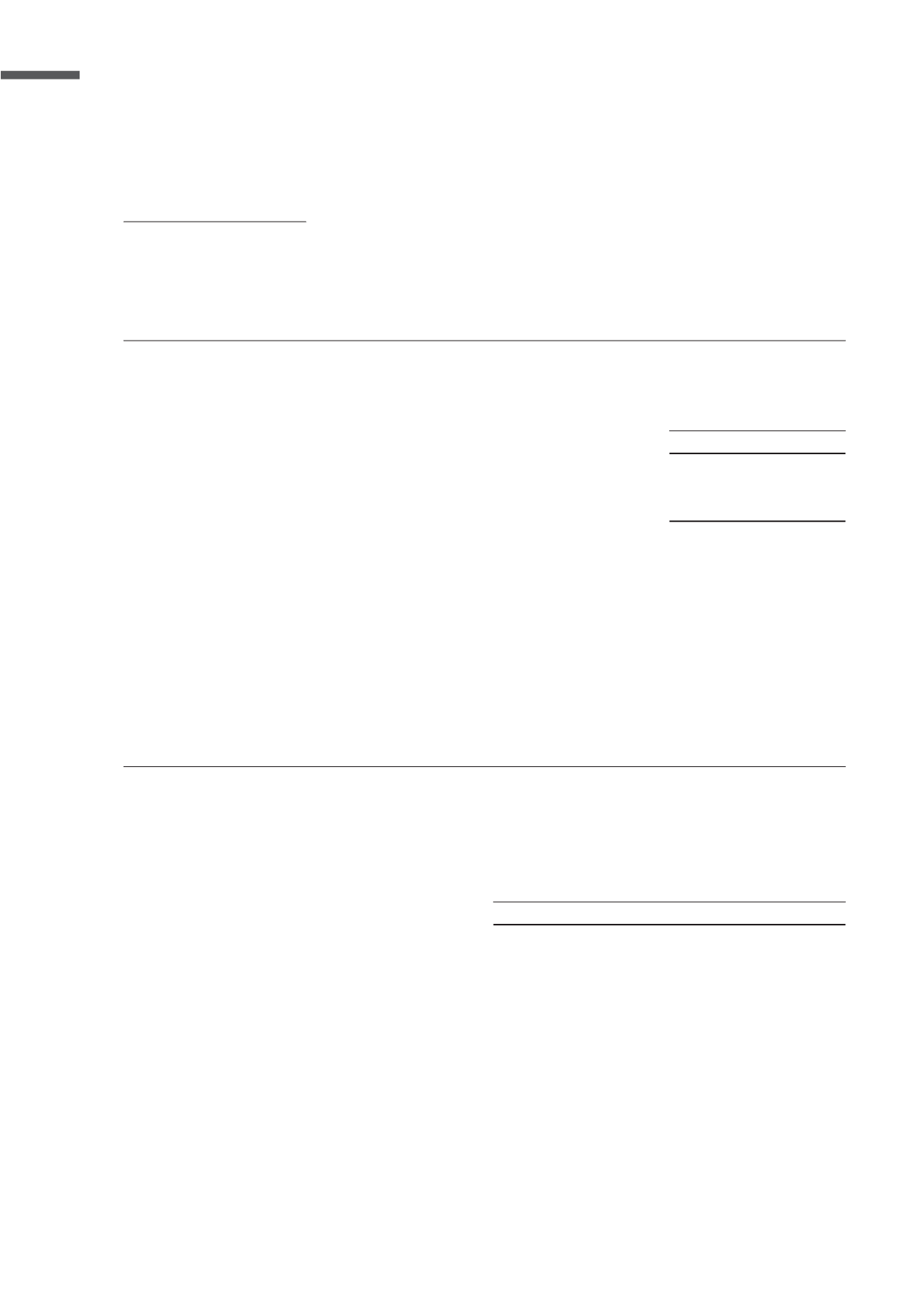

Receivables that are impaired

The Group’s trade receivables that are impaired at the end of reporting period and the movement of the

allowance account used to record the impairment is as follows:

Trade receivables that are individually determined to be impaired at the end of reporting period relate to debtors

WKDW DUH LQ VLJQLȴFDQW ȴQDQFLDO GLɝFXOWLHV DQG KDYH GHIDXOWHG RQ SD\PHQWV 7KHVH UHFHLYDEOHV DUH QRW VHFXUHG E\

any collateral or credit enhancements.

At end of the reporting period, the Group has provided an allowance of S$34,000 (2014: S$Nil) for impairment of

an amount due from an external trade debtor relating to a backcharge as the debtor has defaulted on payments.

18.

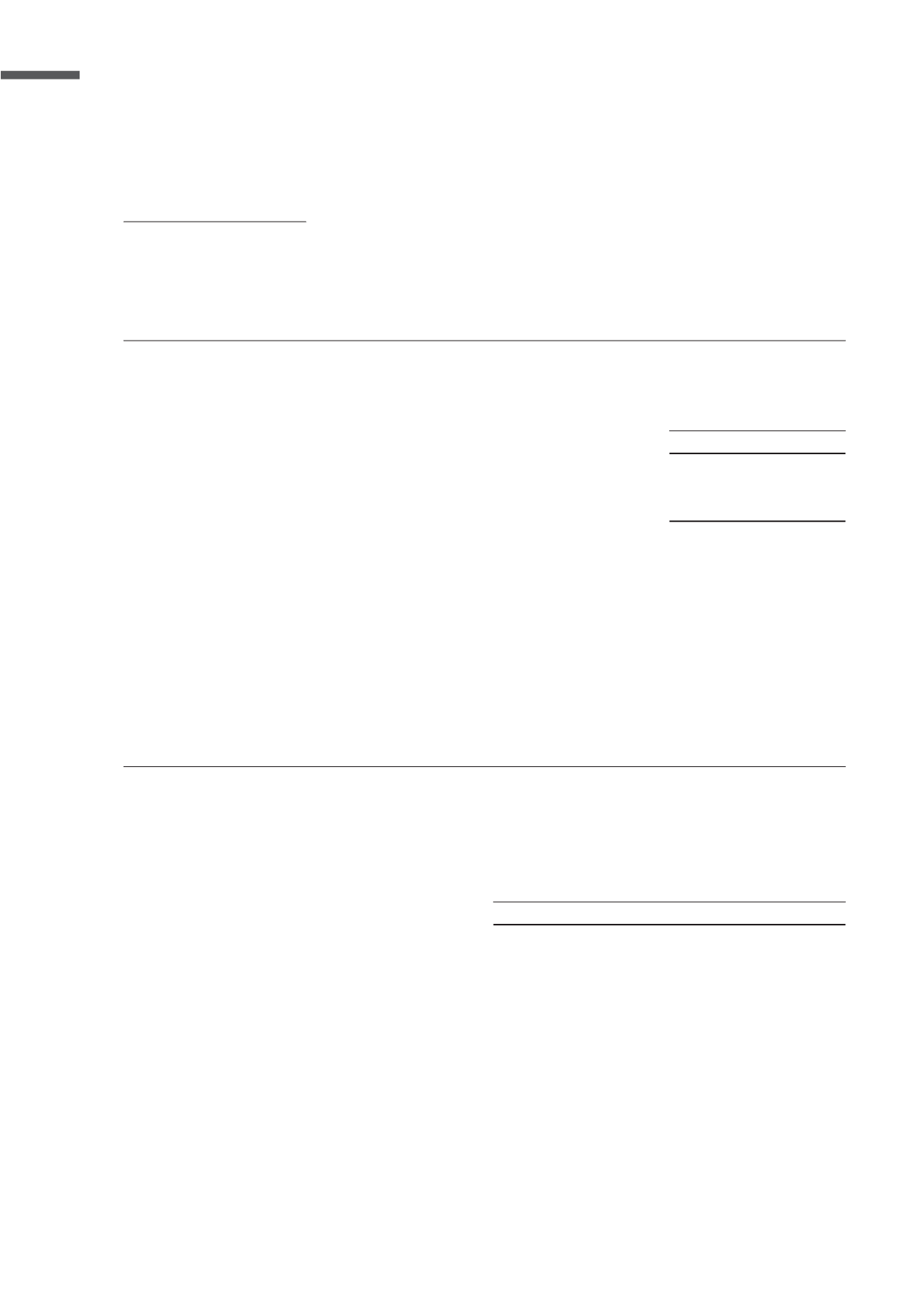

Other receivables

Amounts due from subsidiaries are non-trade related, non-interest bearing, unsecured, repayable on demand

DQG LV WR EH VHWWOHG LQ FDVK 7KH DPRXQWV UHODWH WR PDQDJHPHQW IHH DQG SD\UROO FRVWV RI VHFRQGHG VWD FKDUJHG

to subsidiaries.

Loans due from subsidiaries are unsecured, bear interests ranging from 0.68% to 1.31% (2014: Nil%) per annum,

repayable on demand and are to be settled in cash.

Group

Individually impaired

2015

2014

S$’000

S$’000

Trade debtors - nominal amounts

34

ȫ

Less: Allowance for impairment

(34)

ȫ

–

–

Movement in allowance account:

Charge for the year and at 31 December

34

ȫ

Group

Company

2015

2014

2015

2014

S$’000

S$’000

S$’000

S$’000

Other debtors

764

909

–

–

Dividend receivable from a subsidiary

–

–

ȫ

37,800

Amounts due from subsidiaries

–

–

2,389

3,308

Loans due from subsidiaries

ȫ

ȫ

9,050

ȫ

764

909

11,439

41,108

HOCK LIAN SENG HOLDINGS LIMITED

72