Notes to the Financial Statements

31 December 2015

13.

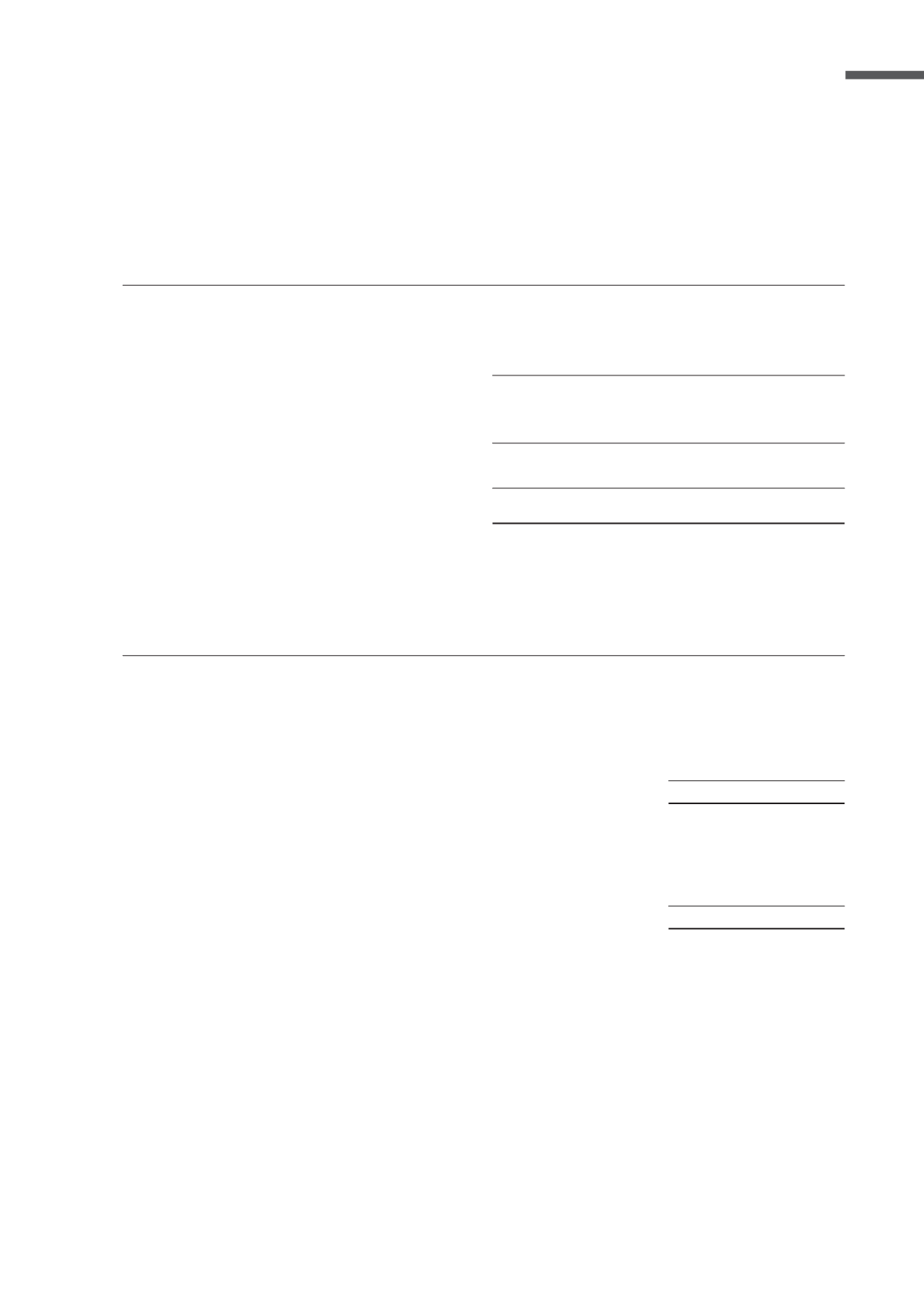

Investment in joint ventures (cont’d)

Summarised statement of comprehensive income

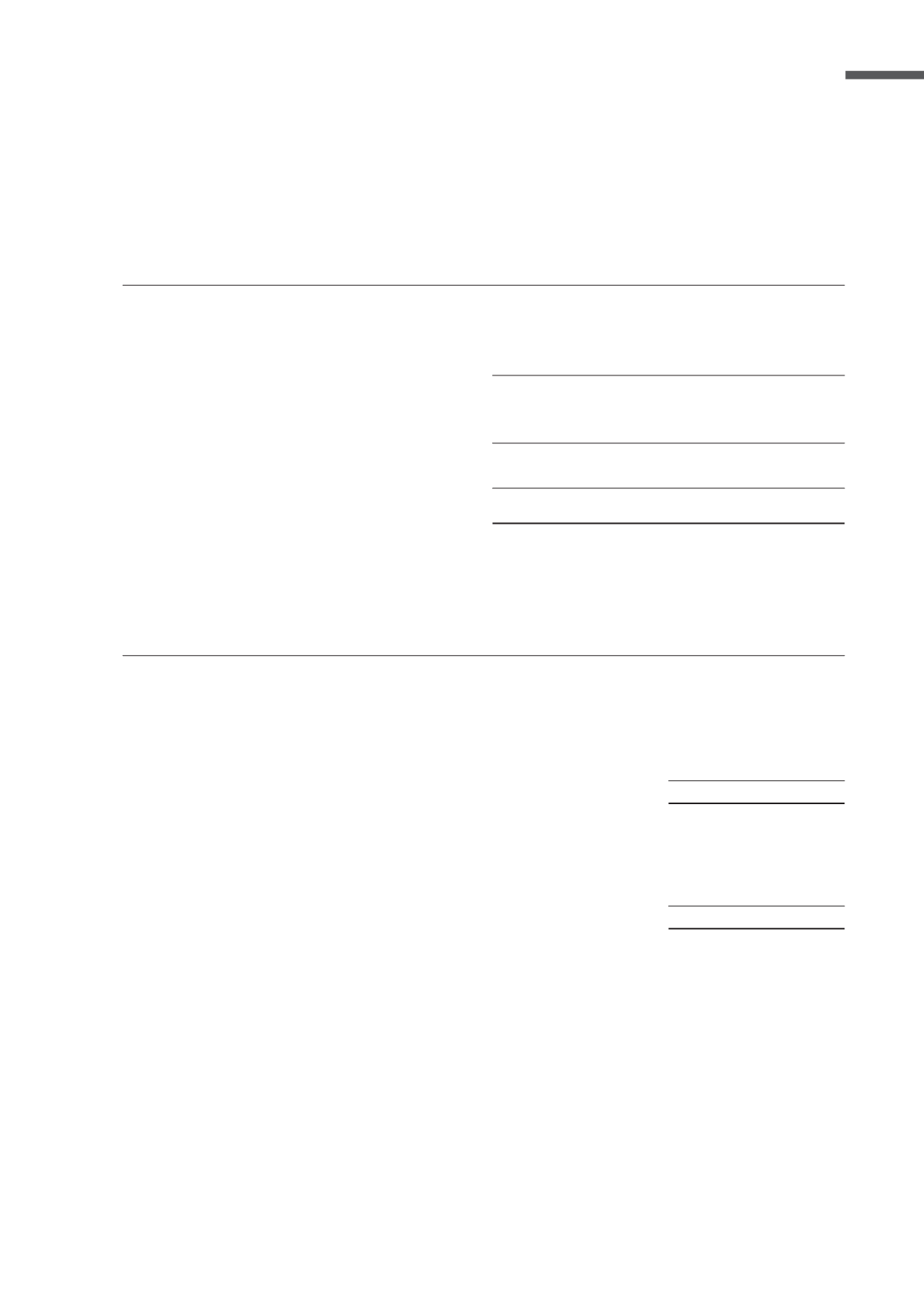

14.

Investment securities

Held-to-maturity investment in quoted corporate bonds were made for varying coupon rates ranging from 3.15%

to 7.0% (2014: 3.15% to 7.0 %) per annum, with maturity dates ranging from 2016 to 2027.

Bukit Timah Green

Development Pte Ltd

HLE Management

Pte Ltd

2015

2014

2015

2014

S$’000

S$’000

S$’000

S$’000

Revenue

301,300

89,516

ȫ

3

Cost of sales

(282,733)

(86,599)

ȫ

–

*URVV SURȴW

18,567

2,917

ȫ

3

Other income

90

40

ȫ

–

Operating expenses

(1,278)

(2,850)

(6)

(6)

3URȴW ORVV EHIRUH WD[

17,379

107

(6)

(3)

Tax expense

(2,955)

(18)

ȫ

–

3URȴW ORVV DIWHU WD[

and total comprehensive income

14,424

89

(6)

(3)

Group

2015

2014

S$’000

S$’000

Non-current

Held-to-maturity investments

22,772

23,809

$YDLODEOH IRU VDOH ȴQDQFLDO DVVHWV

Equity instruments (quoted)

1,710

1,252

24,482

25,061

Current

Held-to-maturity investments

5,502

–

)LQDQFLDO DVVHWV DW IDLU YDOXH WKURXJK SURȴW RU ORVV

Equity instruments (quoted)

3,245

2,710

8,747

2,710

ANNUAL REPORT 2015

69