Notes to the Financial Statements

31 December 2015

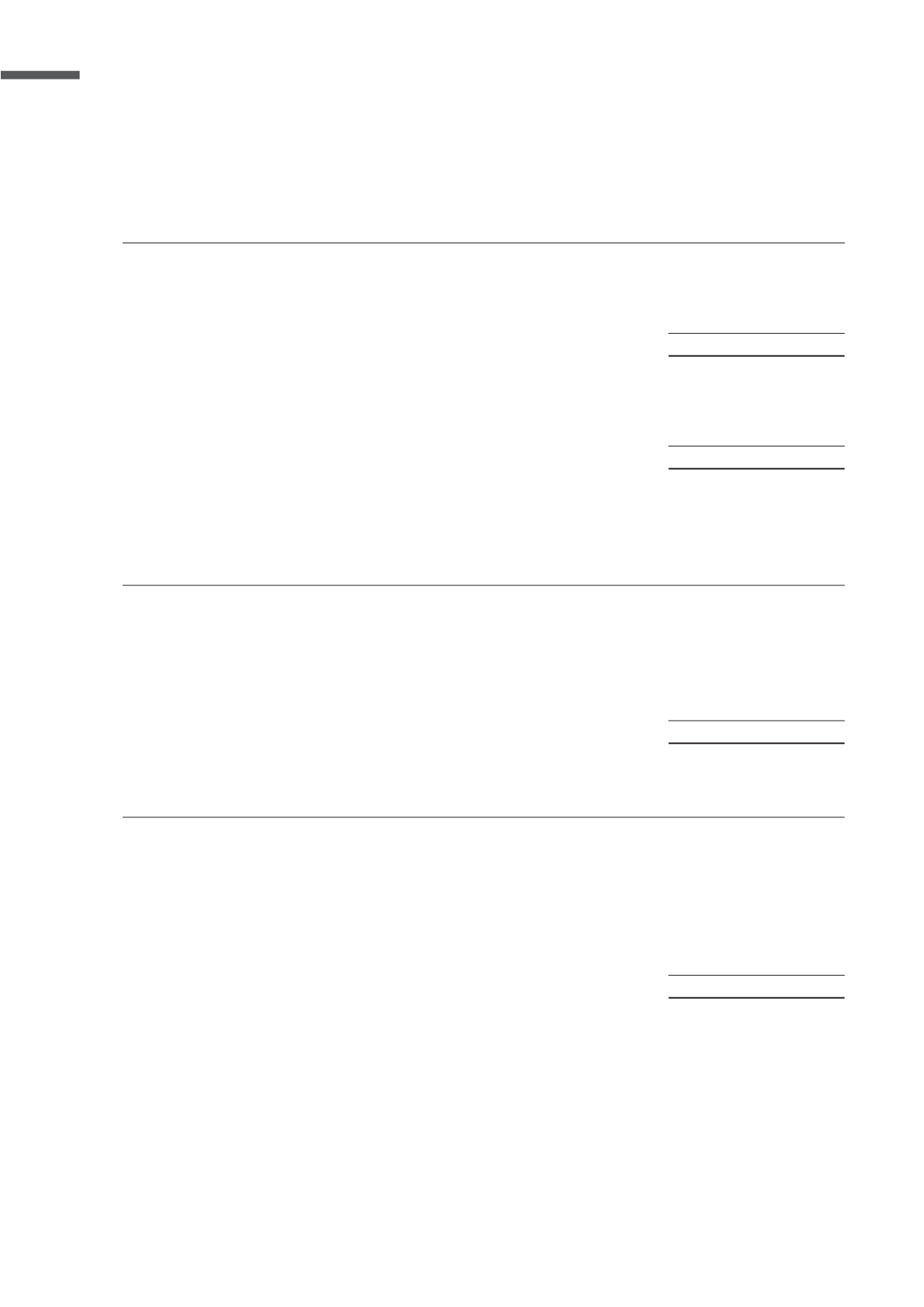

15.

Contract work-in-progress/(progress billings in excess of work-in-progress)

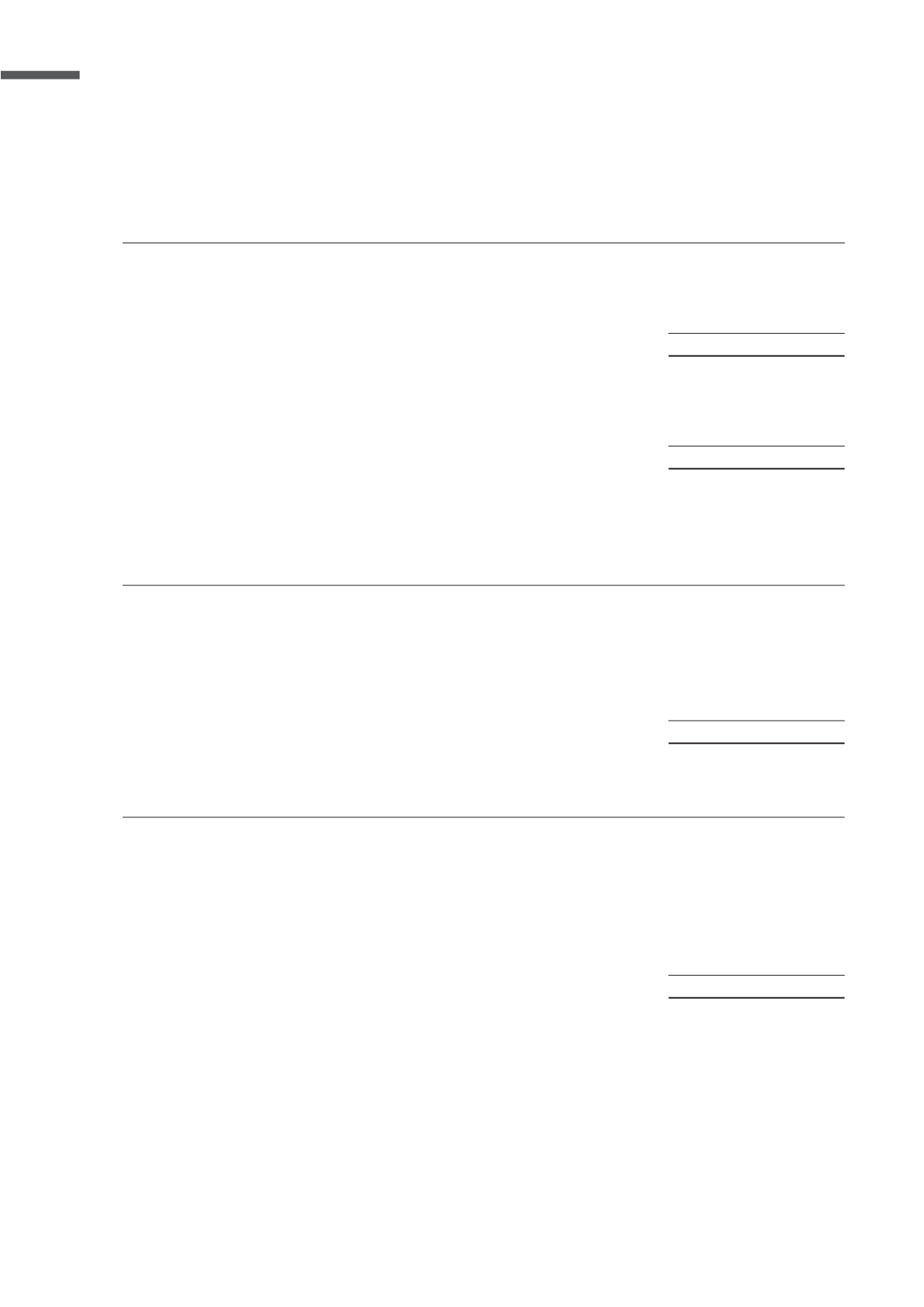

16.

Development properties

'XULQJ WKH ȴQDQFLDO \HDU ERUURZLQJ FRVWV RI 6

6

DULVLQJ IURP ERUURZLQJV REWDLQHG

VSHFLȴFDOO\ IRU WKH GHYHORSPHQW SURSHUWLHV ZHUH FDSLWDOLVHG XQGHU Ȋ'HYHORSPHQW FRVWVȋ IRU SURSHUWLHV XQGHU

construction. The rates used to determine the amount of borrowing costs eligible for capitalisation range

IURP WR

WR

SHU DQQXP ZKLFK DUH WKH HHFWLYH LQWHUHVW UDWHV RI WKH VSHFLȴF

borrowings.

The cost of the properties under construction amounting to S$37,485,000 (2014: S$Nil) is expected to be

recovered more than twelve months after the reporting period.

Group

2015

2014

S$’000

S$’000

$JJUHJDWH DPRXQW RI FRVWV LQFXUUHG DQG UHFRJQLVHG SURȴWV WR GDWH

967,553 884,727

Less: Progress billings

(957,278)

(881,139)

10,275

3,588

Presented as:

Contract work-in-progress

12,103

6,696

Progress billings in excess of work-in-progress

(1,828)

(3,108)

10,275

3,588

Group

2015

2014

S$’000

S$’000

Completed properties, at cost

9,225

20,940

Properties under construction:

Leasehold land

31,136

25,276

Development costs

6,349

27,304

46,710

73,520

Group

2015

2014

S$’000

S$’000

At 1 January

73,520 157,874

Construction costs incurred

40,703

55,413

Interest capitalised

546

623

Transfer to completed investment property

(1,381)

–

Disposals (recognised in cost of sales)

(66,678)

(140,390)

At 31 December

46,710

73,520

HOCK LIAN SENG HOLDINGS LIMITED

70