Notes to the Financial Statements

31 December 2015

16.

Development properties (cont’d)

The carrying amount of the development property under construction has been pledged as security for a bank

loan (Note 25).

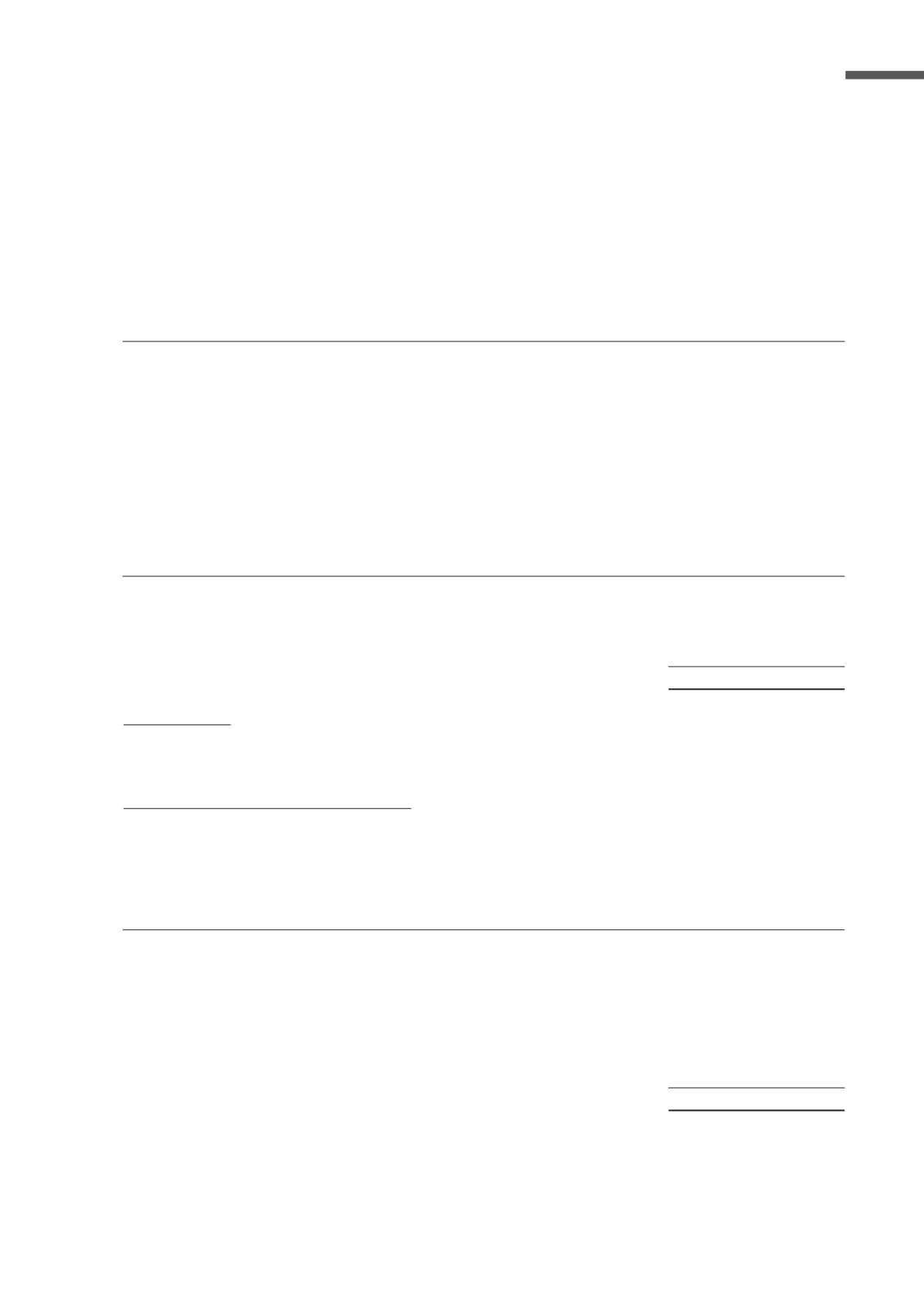

List of development properties

* The construction of the industrial property was completed in 2014.

17.

Trade receivables

Trade receivables

Trade receivables are non-interest bearing and are generally on 14-56 days’ credit terms. They are recognised at

their original invoice amounts which represent their fair values on initial recognition.

Receivables that are past due but not impaired

The Group has trade receivables amounting to S$121,000 (2014: S$32,000) that are past due at the end of the

reporting period but not impaired. These receivables are unsecured and the analysis of their ageing at the end

of the reporting period is as follows:

Description and location

%

owned

Site area

VTXDUH

metre)

Approximate

VDOHDEOH ȵRRU DUHD

VTXDUH PHWUH

Stage of completion as

at date of annual report

(expected year of completion)

Industrial property at

Tuas South Avenue 7

100

25,700

49,489

4.7% (2018)

Industrial property at

Gambas Avenue

100

21,427

49,046

100% (2014*)

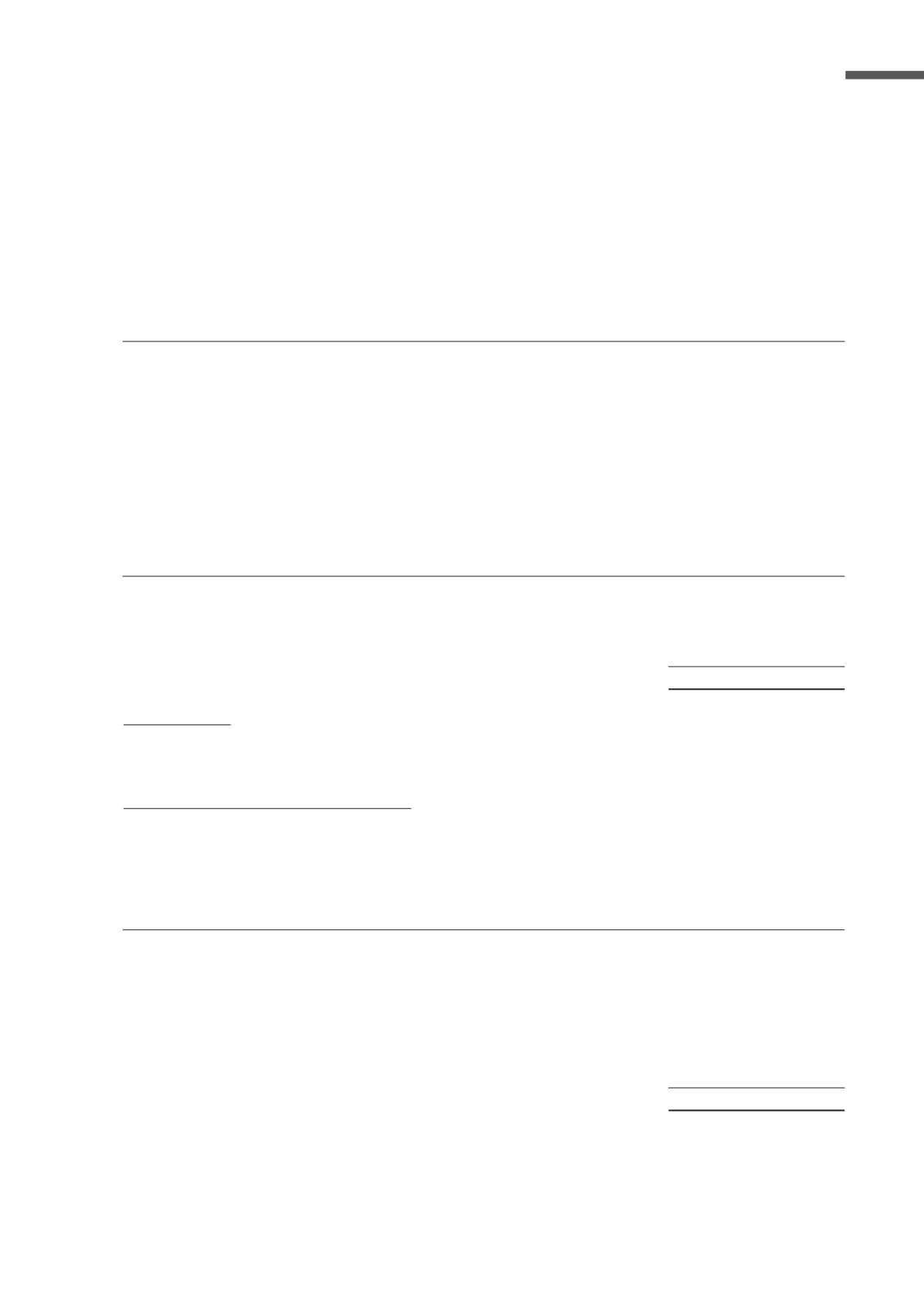

Group

2015

2014

S$’000

S$’000

Trade receivables

6,469

42,415

Allowance for impairment

(34)

–

6,435

42,415

Group

2015

2014

S$’000

S$’000

Trade receivables past due but not impaired:

Lesser than 30 days

ȫ

5

30 to 60 days

75

8

60 to 90 days

ȫ

3

More than 90 days

46

16

121

32

ANNUAL REPORT 2015

71